Operational Gearing Formula

Operating leverage is a measurement of the degree to which a firm or project incurs a combination of fixed and variable costs. A companys total debt-to-equity ratio is a critical measure of its financial health.

Operating Leverage Formula And Calculator Excel Template

The formula for an operating ratio can be derived by using the following steps.

. For example if a companys revenue has grown from 25 million to 30 million then the formula for the YoY growth rate is. Capitalization ratios are indicators that measure the proportion of debt in a companys capital structure. Hence chips play a crucial role in the overall operational activity of these vehicles.

Firstly determine the cost of goods sold by the company. Reports the following numbers to the bank. A high gearing ratio is anything above 50.

You can easily calculate the Revenue Per Employee Ratio using Formula in the template provided. Pirelli the sole supplier of Formula One tyres said its adjusted earnings before interest and tax EBIT came at 253 million euros 258 million in the April-June period topping a company. Electric vehicles and modern cars are largely dependent on software.

In 2011 the EBITDA was Rs257 Crs and in 2014 the EBITDA is Rs560Crs. It helps the investors determine the organizations leverage position and. Revenue Per Employee Ratio Formula in Excel With Excel Template Here we will do the same example of the Revenue Per Employee Ratio formula in Excel.

A company with a high gearing ratio will tend to use loans to pay for operational costs which means that it could be exposed to increased risk during economic downturns or interest rate increases. The lack of electric vehicle charging infrastructure adds to this. Please note we have discussed the formula for CAGR in module 1.

The operational justification of the theorem can be visualized. First calculate the gearing ratio using the Debt to equity ratio Debt To Equity Ratio The debt to equity ratio is a representation of the companys capital structure that determines the proportion of external liabilities to the shareholders equity. YoY Growth 30 million 25 million 1 200 Alternatively another method to calculate the YoY growth is to subtract the prior period balance from the current period balance and then divide that amount by the.

As of 2022 Darktrace has a banner partnership with McLarens Formula 1 Racing Team. It is the summation of all direct and indirect costs that can be assigned to the job orders and it primarily comprises raw material cost direct labor cost and manufacturing. Range anxiety is a major reason that poses a bottleneck to the growth of electric vehicles.

Their second attempt on capital structure included taxes has identified that as the level of gearing increases by replacing equity with cheap debt the level of the WACC drops and an optimal capital. While some debt is good to take advantage of market opportunities too much debt can make lenders nervous and put the company at substantial risk of bankruptcy in the event of an economic downturn. References This page was last edited on 24 August 2022 at.

It is very easy and simple. Currently Darktrace can cover Industrial Operational Technology Email SaaS Cloud Network and Endpoint. A low gearing ratio is anything below 25.

An optimal gearing ratio is anything between 25 and 50. The formula however has implications for the difference with the WACC. This is a good sign as it shows consistency and efficiency in the managements operational capabilities.

Walmart Balance Sheet Explanation. You need to provide the two inputs ie Revenue and Number of Employees. This translates to a 4 year EBITDA CAGR growth of 21.

A business that makes sales providing a very high gross margin and.

Gearing Formula How To Calculate Gearing With Examples

Operating Leverage Formula Calculator Example With Excel Template

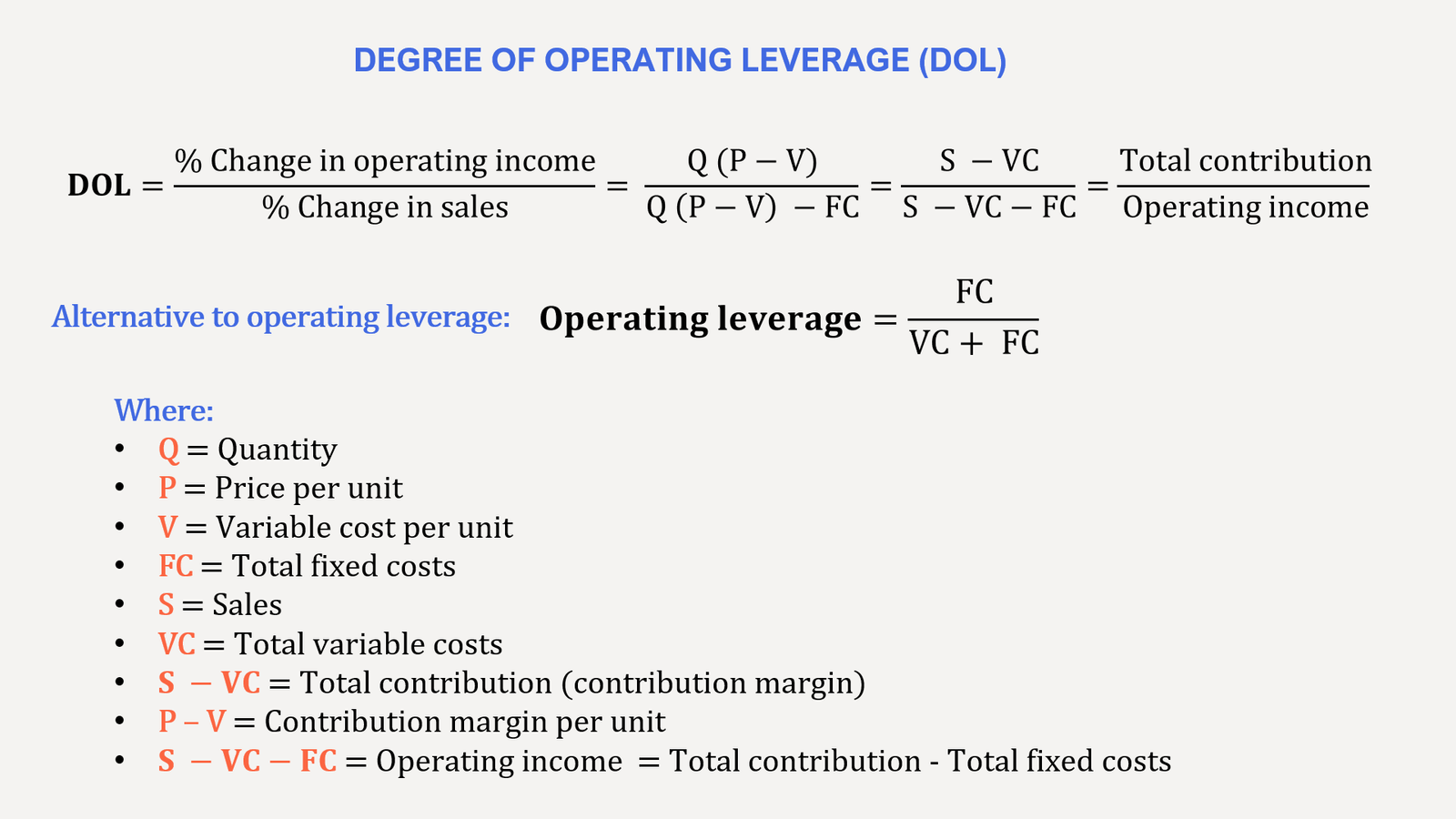

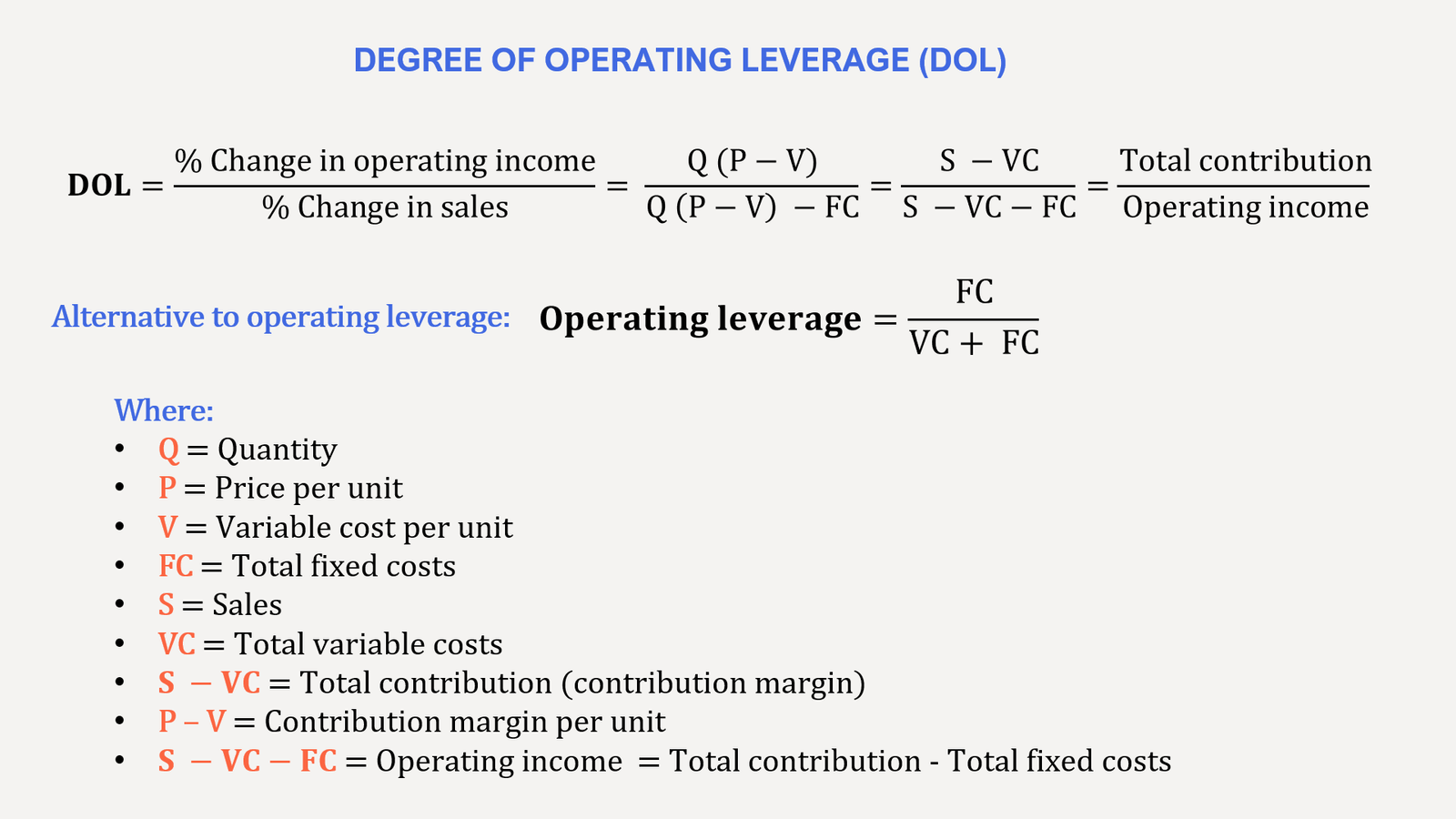

Degree Of Operating Leverage Fundsnet

Operating Leverage Why It Matters How To Calculate It Penpoin

No comments for "Operational Gearing Formula"

Post a Comment